History of Economic Crises. Part 2: Stock Market Crashes

In the first part of this series, which you can find here, we described the first economic crises that occurred worldwide. Today, we will continue and take a closer look at the first stock market crashes.

First International Crisis

When did the first international economic crisis occur? Some date it back to 1720. It was a speculative mania that took place from 1717 onwards. Although it mainly affected France and Great Britain, its echoes were felt in the Netherlands, Italy, and Hamburg.

We are referring specifically to the speculative bubbles of the Mississippi Company and the South Sea Company. Although one took place in France and the other in Great Britain, they were interconnected. In 1717, English investors envied what was happening on the French market. People discovered the marvelous invention of the stock market. Banks and companies were traded, fueled by completely empty money. This money was printed in abundance by a central bank created by a charlatan, a swindler, and above all an economic trickster – John Law. By the way, his biography would make a perfect script for a multi-season TV series.

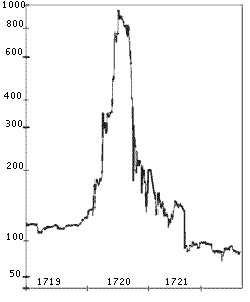

In any case, a bubble was growing in Paris, and it was talked about so much that even the English ambassador in France was asked by his compatriots to buy shares. When that didn’t help, those same people crossed the English Channel to buy securities. It is estimated that we are talking about even 30,000 people!

All of this did not go unnoticed by the authorities. They began to fear that capital would start flowing out of Great Britain en masse. As a result, they decided to create demand for something of their own that would encourage investors to invest in their country. This brings us to the bubble of the South Sea Company.

London’s Response

The shares of the mentioned company turned out to be very attractive to investors. They were bought by people from Paris, Geneva, The Hague, and Amsterdam. Although it was clear that a bubble was now forming on the London market, even experienced financiers invested in it. One banker said, “Since everyone has gone mad, we have to imitate them to some extent.”

The financial centers benefited from both bubbles. Amsterdam is an example. The Dutch bought and then sold French shares at almost perfect moments. Market actions were also taken there. In June and July 1720, ships were sailing between Great Britain and Amsterdam every 12 hours. There was speculation about insurance company shares.

Crash

In the end, all of these bubbles burst. The financial system that Law had built collapsed. Some claim that as a result of this disaster, the French Revolution indirectly erupted (the whole country faced financial problems). Law himself fled and died in poverty.

However, this did not mean that any lessons were learned from all of this…

To be continued.

![How Bitcoin Becomes a Lifeline for Victims of Repression and Financial Exclusion – Explains Lyudmyla Kozlovska [INTERVIEW]](https://webeconomy.info/wp-content/uploads/2023/10/Ludmila-Kozlowska-1000x500.jpg)